Press Releases

LMA hosts first Developing Markets conference & releases results of its survey

26 March 2014The Loan Market Association (LMA) today hosted its first conference focused entirely on developing markets. The conference has come about as a result of the LMA's increased activity in these jurisdictions, reflective of the significant growth and investment opportunities these regions present. It follows on from the LMA's successful launch of a suite of recommended forms of facility agreement for use in developing market loan transactions and its recent integration with the African Loan Market Association. It also coincides with the launch of the LMA's new developing markets microsite, produced specifically for members active in developing market jurisdictions.

Clare Dawson, Chief Executive of the LMA, said:

"We are very pleased to introduce, to our annual events calendar, a conference which focuses entirely on developing market jurisdictions. This will provide our members with a forum in which to discuss the opportunities and challenges of lending to these regions. The conference is one of the many recent initiatives we have undertaken in the developing markets space and forms part of our overarching aim to develop a stable, liquid and accessible loan market across the whole of EMEA. We hope that this conference, together with our new microsite and suite of documentation dedicated to developing markets, will provide members with a wealth of relevant and useful information."

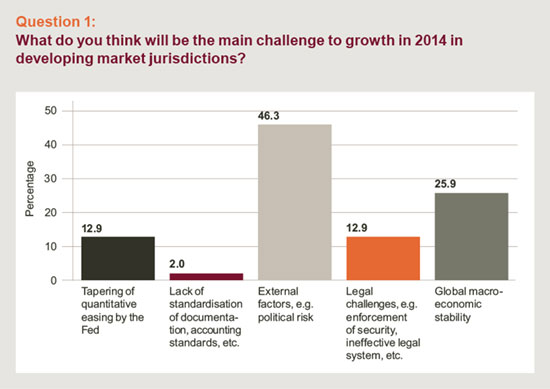

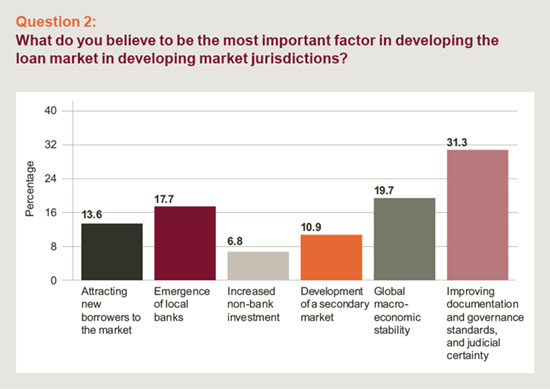

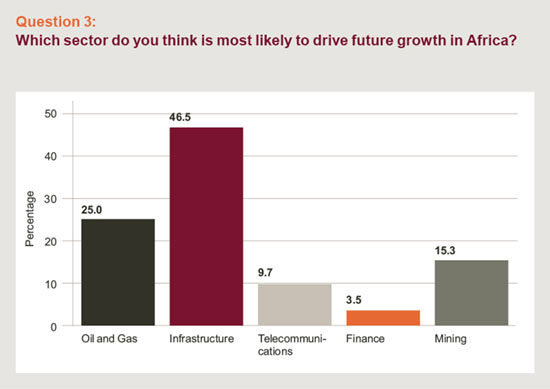

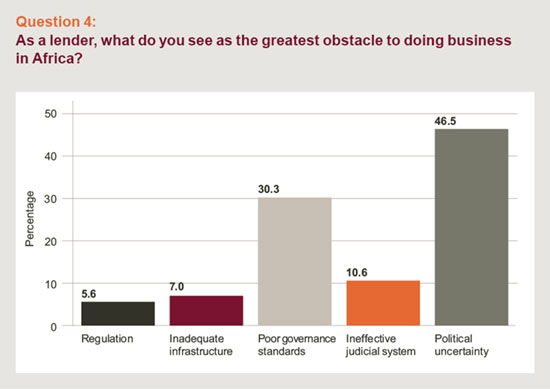

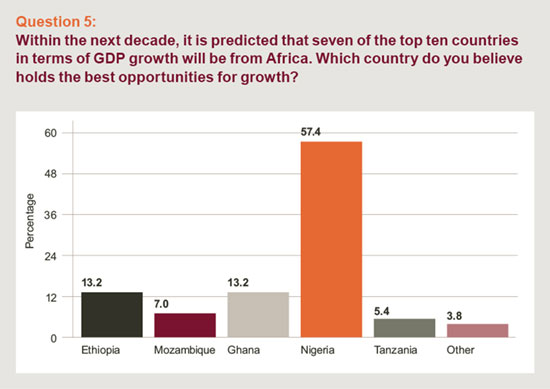

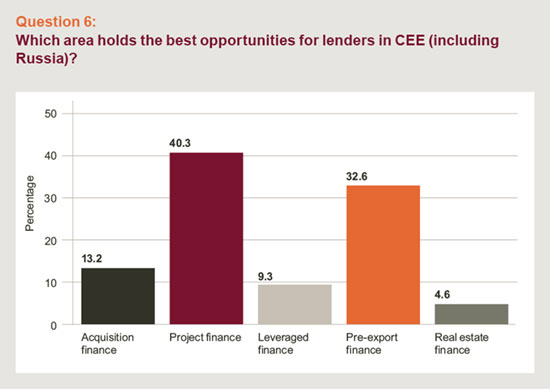

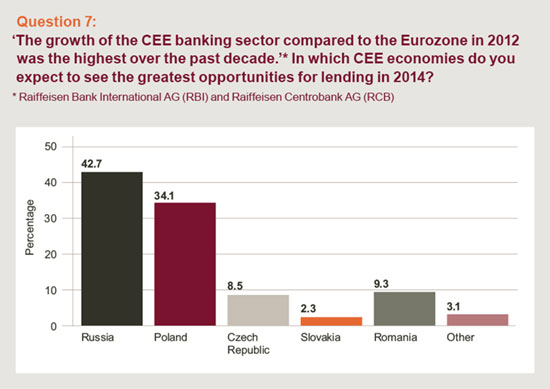

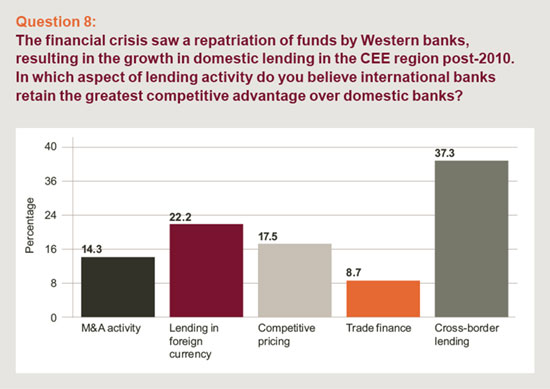

As part of the run up to the Developing Markets conference, the LMA also surveyed its membership on the opportunities and challenges facing developing markets. Focusing primarily on Africa and Central and Eastern Europe, the survey aimed to determine where the key investment opportunities and challenges lay, which sectors were most likely to drive future growth, and which factors would be most important in developing the loan market within these jurisdictions. These themes will be picked up, and discussed in greater detail, by conference panellists.

The results, set out below, were collected anonymously and represent the personal views of loan market professionals from 21 countries around the world.

Clare Dawson, Chief Executive of the LMA, said:

"It is unsurprising that a third of participants surveyed believed that improving documentation standards was one of the most important factors to developing the loan market in developing market jurisdictions. This is very much reflective of the LMA's belief that standardised documentation, with a common framework and language, is one of the key drivers behind improving liquidity and efficiency in the market."