Press Releases

Outlook for the syndicated loan market in 2016

03 December 2015In November 2015, we surveyed our membership on the outlook for the syndicated loan market over the next 12 months. The survey comprised 12 multiple choice questions covering both the primary and secondary markets in general, real estate finance and the developing markets specifically, and lastly regulation.

The results, below, were collected anonymously and represent the personal views of our members, from 27 countries, actively working in the loan market today. To download the results in a pdf click here.

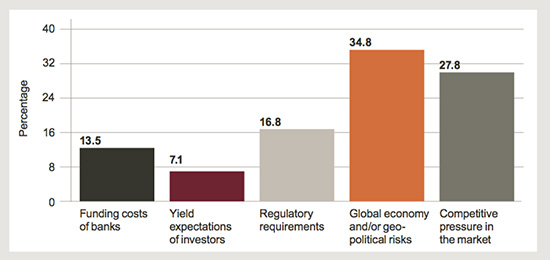

Question 1: Which topic do you think will most influence the syndicated loan market over the next 12 months?

The steady increase in global political and economic tension/uncertainty is reflected in risks in this area rising from second place last year (31.9%) to first place this year (34.8%). This trend is even more marked if we remember that for 2014 this risk was perceived to be around 16%. Competitive pressure is down about 10% to 27.8%, with regulatory requirements falling slightly to 16.8%. External factors are therefore likely to impact significantly on the market in the coming year.

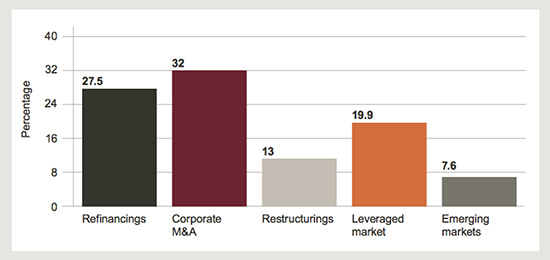

Question 2: Next year, where do you think the best opportunities will lie in the loan market?

The market continues its faith in Corporate M&A, with only a small reduction of 1.5% from last year to 32% this year in those who believe this area offers the best opportunities. Emerging markets continue the decline over the past two years to 7.6%, partly reflecting the concerns which informed the response to the previous question. Those believing in Leveraged market opportunities have risen marginally to 19.9%.

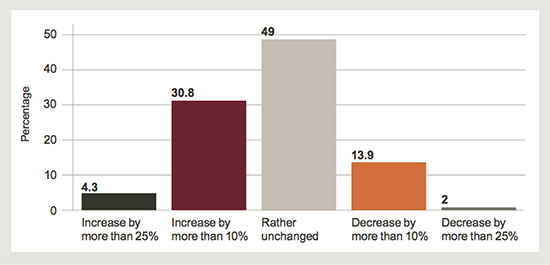

Question 3: What are your volume expectations for 2016 in the EMEA primary syndicated loan market?

The proportion of respondents believing that the probability of volumes will be unchanged has increased from last year to 49%. Last year this figure was 41.5%. Given the external factors, both geopolitical and economic, weighing on the market, a conservative no growth outlook would appear to be justified. However, 35.1% are expecting growth of at least 10%.

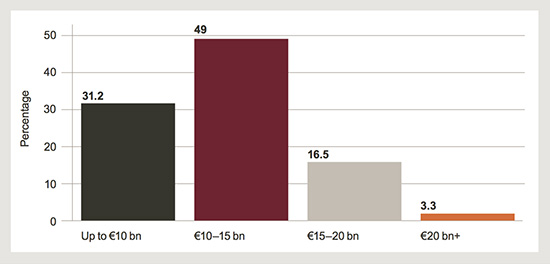

Question 4: What will be the volume of CLO issuance in Europe in 2016?

With full year 2015 European CLO issuance now unlikely to top the €14.5 bn seen in 2014, respondents are understandably cautious about prospects for next year, with a resounding 80% not seeing volumes stretch beyond €15 bn. Last year’s survey produced similar results and those conservative predictions have proved correct.

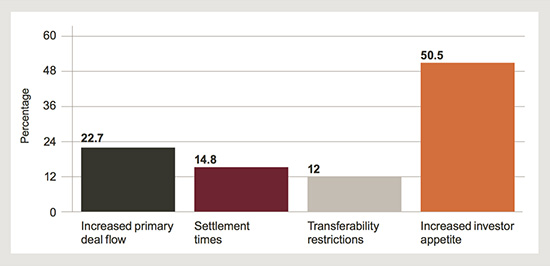

Question 5: What has been the greatest influence on secondary market liquidity in 2015?

Investor appetite has again ensured that secondary in Europe has been generally well bid, providing stability through wider volatility, and soaking up increased auction supply throughout the year.

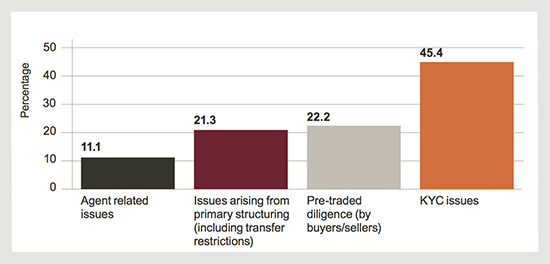

Question 6: What affects settlement times the most in the current market?

Unsurprisingly, KYC issues are again singled out as the main cause of settlement delays, with sell and buyside reporting closing times regularly impacted. Due diligence and primary structuring are given roughly equal weighting, with market participants noting separately that both can lead to more onerous delays than KYC alone.

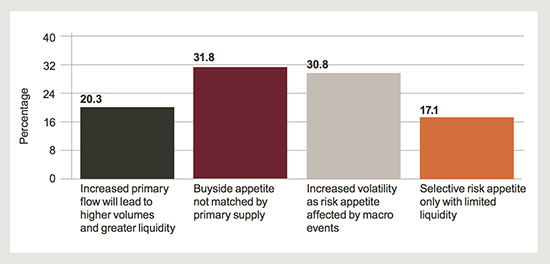

Question 7: What are your expectations for the secondary market in 2016?

Whilst investor demand is again forecast to outpace supply in 2016, respondents also point to the potential for increased volatility, periods of which punctuated wider markets this year.

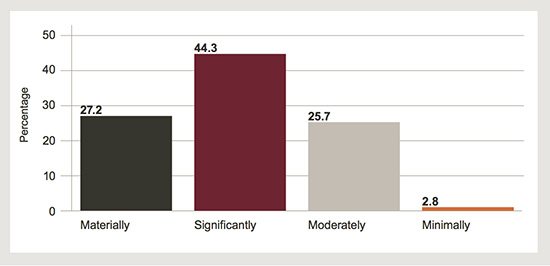

Question 8: How much have the financial regulatory changes over the past five years impacted your business?

The regulatory proposals of the past few years, which have now taken legislative form, are now starting to bite and are impacting both bank and non-bank members. This is well reflected in 71.5% of respondents being at least significantly impacted by the regulatory changes, of which 27.2% have been materially impacted. This represents another external factor impacting the market now and in the future.

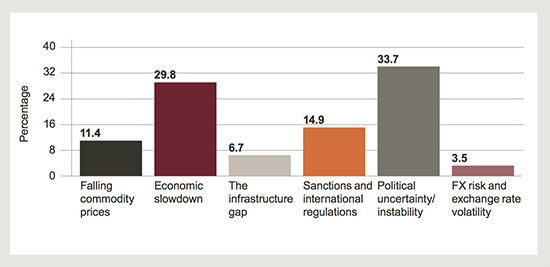

Question 9: What do you think is the principal barrier to developing market growth at the present time?

Last year, respondents cited legal risk as the principal barrier to developing market lending. In 2016, political uncertainty and instability are perceived as posing the greatest challenge to the loan market in developing markets (e.g. the effect of the ongoing sanctions regime in Russia). Headwinds in the global economy (including low commodity prices) are also likely to act as a handbrake on economic growth in developing market jurisdictions, which could constrain lending activity.

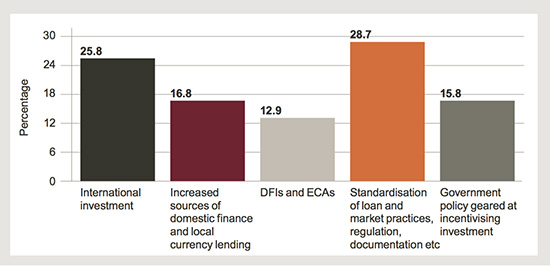

Question 10: What do you think is the most important factor supporting developing market lending at the present time?

The standardisation of loan documentation, regulation and related market practices are considered critical to the growth of syndicated lending in developing market jurisdictions in 2016. While the emergence of domestic sources of financing and local currency lending are seen as important sources of liquidity, greater emphasis is placed on the role played by international lenders in boosting loan volumes in these markets.

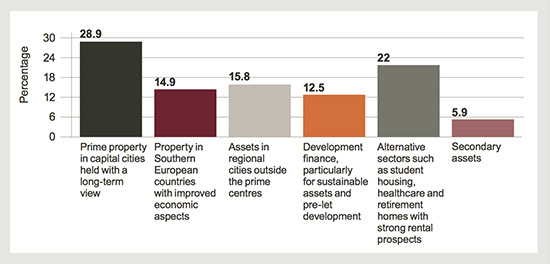

Question 11: In which type of commercial real estate assets do you see the greatest potential for growth?

Prime property, often in perceived “safe haven” cities, continues to remain a key source of investment, attracting investment from around the globe. Investment in alternative sectors looks to remain buoyant going forward, with investment in development finance set to pick up as market conditions improve.

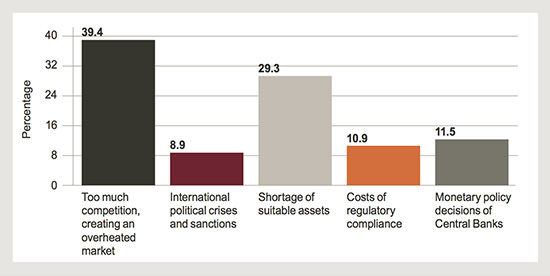

Question 12: What do you think will be the greatest challenge for the European real estate market in 2016?

Competition in real estate remains rife, with supply of investment often outstripping demand. It is therefore no surprise that survey participants see too much competition and a shortage of suitable assets as the two great challenges for the European real estate market in 2016.