Press Releases

LMA launches new Intercreditor Agreement for use in real estate finance transactions

10 June 2014The LMA is pleased to announce the launch of a new recommended form of Intercreditor Agreement for use in real estate finance transactions (the "REF Intercreditor").

The REF Intercreditor was proposed in response to demand from members active in the real estate finance market who were increasingly seeing loans provided via a combination of senior and mezzanine finance. Whilst it was recognised that the nature of these transactions, the variety of potential lending structures and the various stakeholders involved in the process would make it difficult to produce a "one size fits all" document, members felt that the basic formulation of a standard form template would be a step forward in achieving greater efficiencies and standardisation across the market, by providing a common framework and language for those involved in these transactions. The LMA believes that this will enable market participants to concentrate on the key commercial drivers and structural nuances which form the basis of their transactions.

The REF Intercreditor, for use in conjunction with the LMA's Recommended Form of Facility Agreement for real estate finance multi-property investment transactions, uses the same "boilerplate" as the LMA Recommended Form of Intercreditor Agreement for the leveraged finance market and so should be immediately familiar to all users of LMA documentation.

The REF Intercreditor was put together and agreed by an experienced working party, consisting of representatives from banks (including in-house lawyers), mezzanine finance providers and major City law firms, and was based on their first-hand experiences of undertaking such transactions.

Commenting on the document, Clare Dawson, LMA Chief Executive, said:

"Real estate finance forms a significant part of the syndicated loan market and is a key contributor to economic growth. The LMA remains committed both to fostering REF liquidity and assisting its members who are active in the market and we believe that the production of REF specific documentation provides one of the best ways of achieving these aims, by improving general efficiencies and helping to attract new investment."

Further information is provided below:

- What is the aim of the REF Intercreditor?

The REF Intercreditor seeks to govern the relationship between two classes of creditor providing finance to the same borrower group in the context of a real estate finance transaction. It does this by ranking the creditors' debt and their entitlements to the proceeds of any guarantees and security and by contractually restricting their behaviour: for example, by controlling when and by whom security might be enforced and when payments can be made by a borrower to a given class of creditor. - What type of transaction is the REF Intercreditor applicable to?

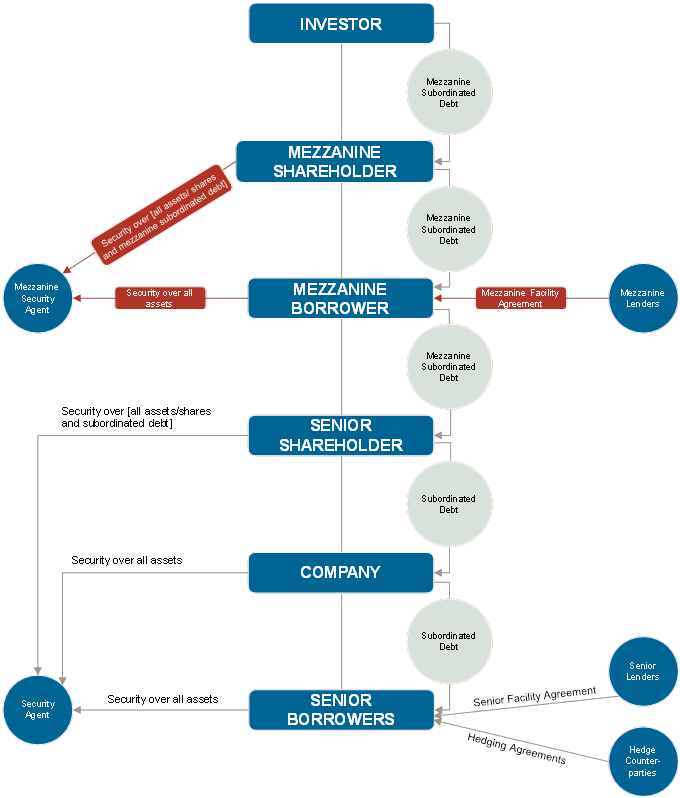

The REF Intercreditor was prepared on the basis of an assumed corporate, loan and guarantee, security and subordination structure. This structure is depicted below.Within this remit, various optional provisions have been included in square brackets in order that a "menu of clauses" is available to the draftsman should those clauses be required. This is not to say, however, that the REF Intercreditor will not need to be adapted – in fact, it will need to be tailored to each individual transaction, depending on its structure and commercial terms. This is in keeping with other LMA documents, which are intended to provide a sensible starting point and do not attempt to deal with the potential complexities of every possible type of transaction.

- What benefits will the REF Intercreditor bring to the market

The REF Intercreditor will bring numerous benefits to the market.Firstly, increased efficiency will result from the standardisation of boilerplate terms and provision of a common and recognisable legal framework, with the ultimate aim of improving liquidity in the market. A lack of standardisation can lead to increased negotiation and time taken for transactions to complete, particularly where there are different types of stakeholders involved, such as senior and mezzanine lenders. Such increased negotiations and completion times could also make a market less attractive to new investors.

Secondly, the LMA reviews its documents on a regular basis, thus ensuring that they reflect current market practice, accommodate the regulatory and legal framework and continue to meet the needs of participants in the market.

Thirdly, simultaneously with the launch of the REF Intercreditor, the LMA has also published a detailed Users Guide to provide additional guidance and to further assist users with the drafting process.

Finally, the LMA will hold a series of training events and seminars on the REF Intercreditor, both in the UK and abroad.

- Why do you expect the REF Intercreditor to be adopted by market participants?

LMA documentation is widely recognised within the corporate loan markets as a good basis for negotiation, and the LMA's documentation for use in real estate finance transactions is already widely used. It is therefore anticipated that the REF Intercreditor will be embraced in the same way as the LMA real estate finance facility agreements.It should also be highlighted that prior to starting the project, the LMA did considerable market sounding of LMA members who are actively engaged in the real estate finance market, both in a senior and mezzanine capacity. Accordingly, the REF Intercreditor was put together and agreed by an experienced working party, consisting of representatives from banks (including in-house lawyers), mezzanine finance providers and major City law firms. This process should mean that the document is widely acceptable as a starting point within these institutions.

The REF Intercreditor was prepared on the basis of an assumed corporate, loan and guarantee, security and subordination structure.