Press Releases

LMA releases results of its members' survey: outlook for the syndicated loan market in 2018

06 December 2017In November 2017, the LMA surveyed its membership on the outlook for the syndicated loan market over the next 12 months. The survey comprised 14 multiple choice questions covering both the primary and secondary markets in general, real estate finance and the developing markets specifically, and lastly regulation.

The results below were collected anonymously and represent the personal views of the Associations' members actively working in the loan market today. The commentary provided by the LMA compares, where relevant, the results from this year's survey with those of the previous year. To download a pdf of the results click here.

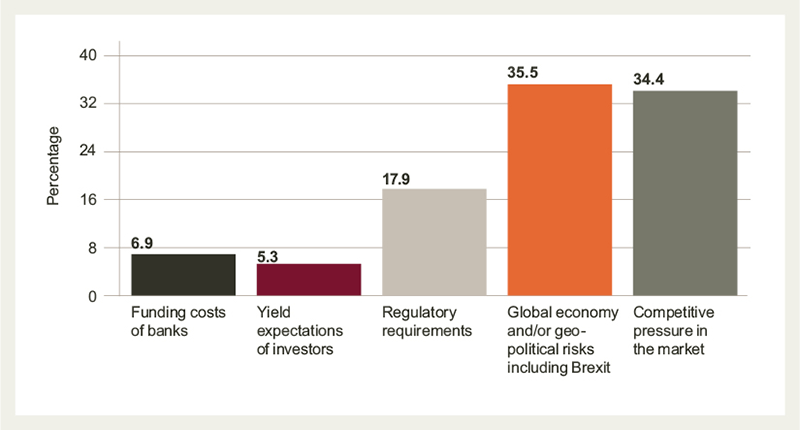

1) Which topic do you think will most influence the syndicated loan market over the next 12 months?

Last year in the aftermath of the Brexit vote and Donald Trump's election, global economy and geopolitical risks jumped significantly from the previous year, from 35% to 51%. A year later, with probably even more geopolitical uncertainty, it might be considered surprising that this response has been reversed back to 35%. It is a measure of the competitive pressures in the market, that despite Trump, North Korea, Brexit, German and UK political instability, not to mention unrest in the Middle East, this concern has risen from 19% to 34%.

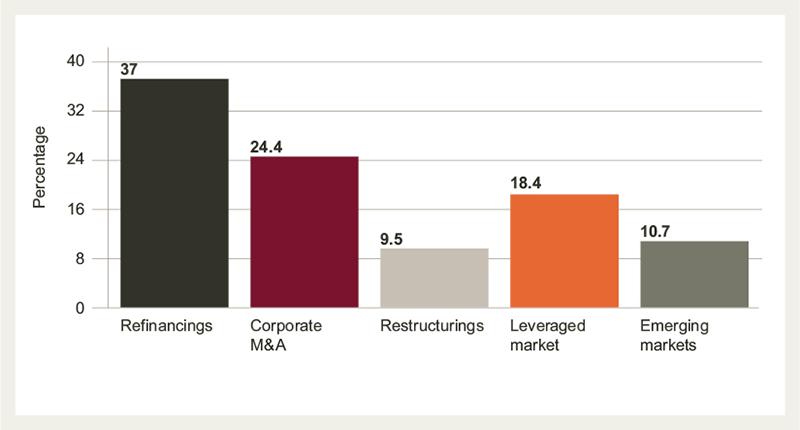

2) Next year, where do you think the best opportunities will lie in the loan market?

Not a very positive response if the market wants to meet and or exceed budgets next year, if refinancing, rising from 27% (in 2016) to 37%, is to be the area where the best opportunities lie. M&A and leveraged are slightly down from previous years. The good news is that restructurings are also expected to be down.

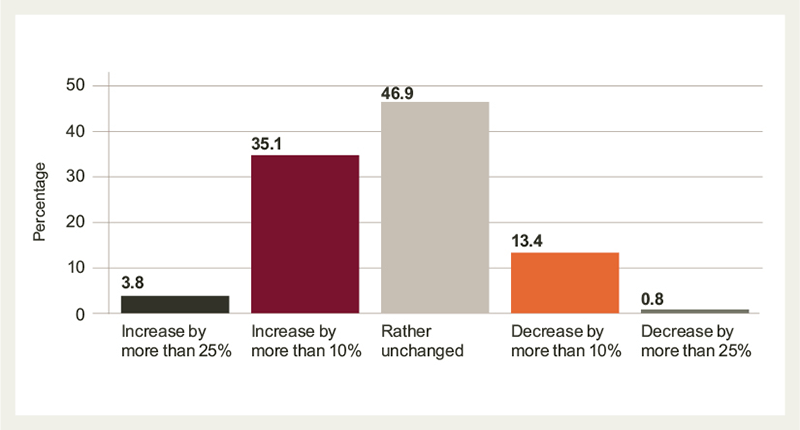

3) What are your volume expectations for 2018 in the EMEA primary syndicated loan market?

Volume outlook is however slightly more positive with 35% expecting an increase of more than 10%, up from 25% last year. However, as noted above, much of this is expected to be refinancings.

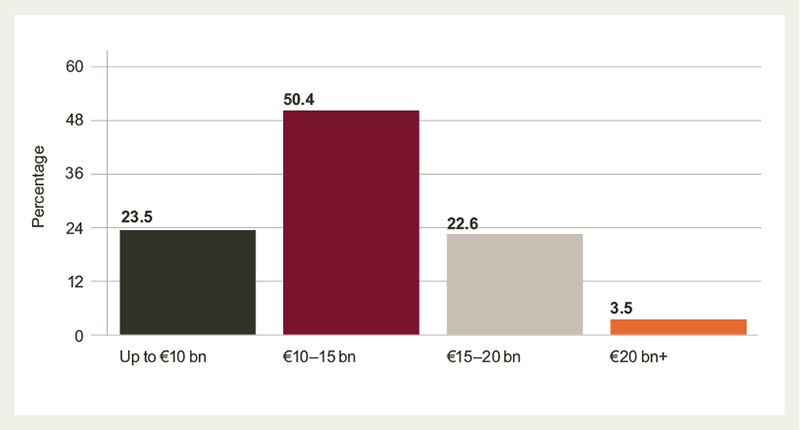

4) What will be the volume of CLO issuance in Europe in 2018?

Very few respondents to last year’s survey predicted the €20 bn+ volume we are set to witness this year. A post crisis record by some distance, 2017 issuance has also seen AAA spreads tighten to the low 70s, easing the arbitrage somewhat as margins are squeezed on the underlying loan collateral in primary. Uncertainty regarding appetite for AAAs at these levels could explain the conservative outlook for new CLO issuance in 2018, few predicting a repeat of this year.

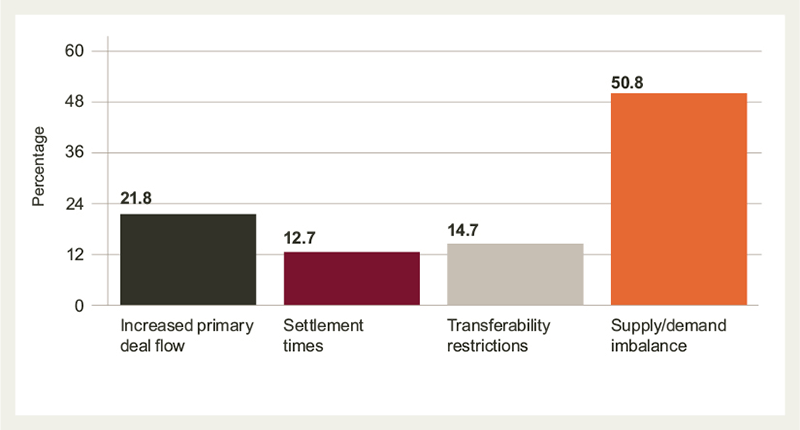

5) What has been the greatest influence on secondary market liquidity in 2017?

Technicals continue to dominate secondary with the market generally well bid throughout the year. Traded volumes are up on increased primary activity but latent demand is clearly still outstripping supply.

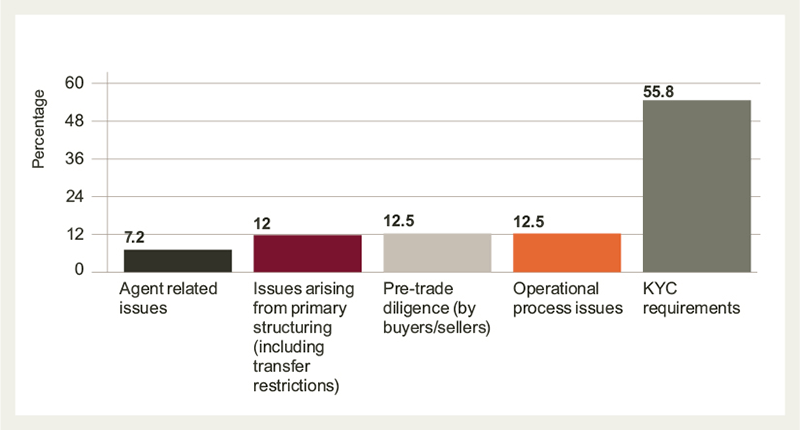

6) What affects settlement times the most in the current market?

KYC issues continue to negatively impact settlement, with reported delays in primary also having a knock-on effect on secondary, as evidenced by LMA settlement statistics steadily widening from Q1.

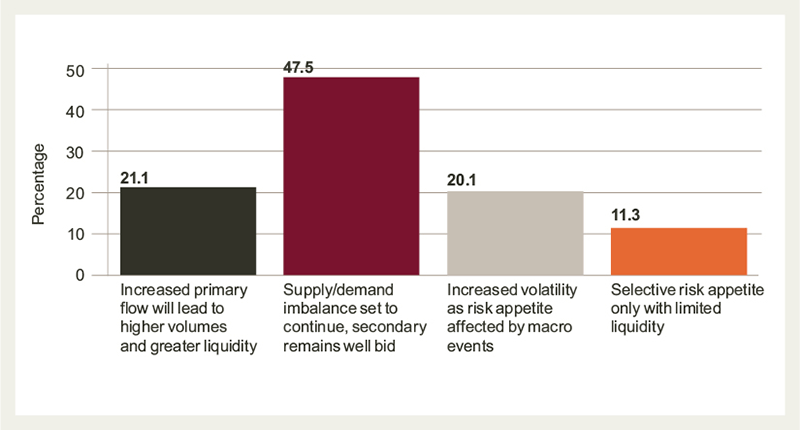

7) What are your expectations for the secondary market in 2018?

As with predictions for this year, respondents see the supply/demand imbalance continuing to shape secondary markets in 2018. Slightly more liquidity perhaps and one eye on the potential for volatility going forward.

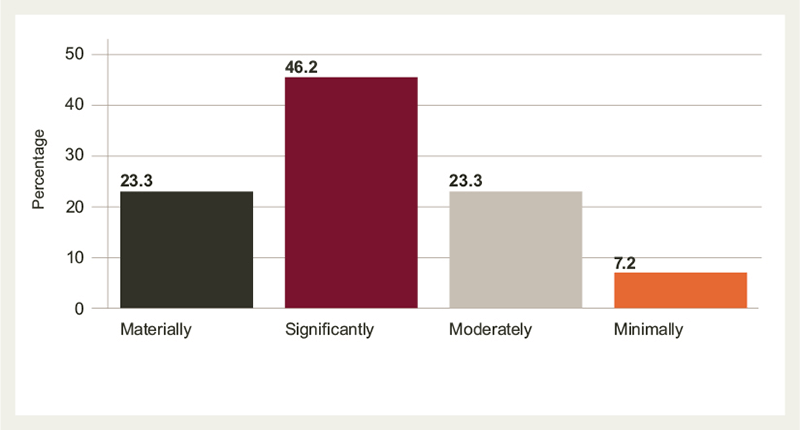

8) How much have the financial regulatory changes over the past five years impacted your business?

Little movement from last year's survey on the impact of regulation. It remains at around 70% who believe it is having a significant/material impact on the business. Not surprising given the continual regulatory flow we are experiencing, with new issues arising this year, such as the leveraged loan guidelines and the potential changes with regard to LIBOR.

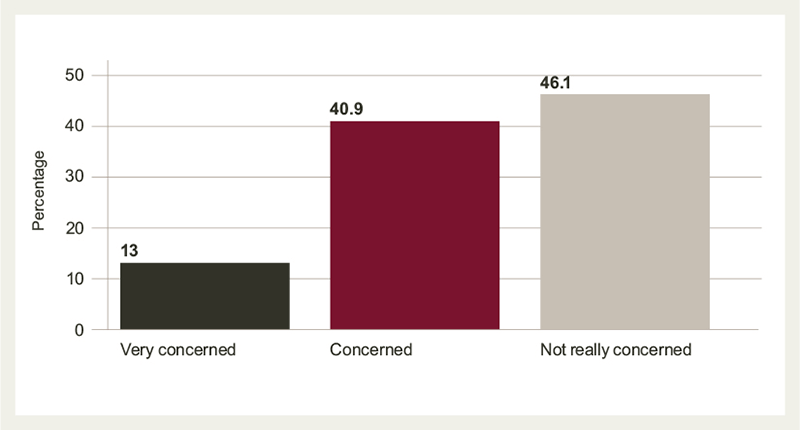

9) Are you concerned about the impact of Brexit on the loan product?

A fairly evenly divided response to this question, with 54% concerned/very concerned and 46% not really concerned. Probably reflects the fact that our membership is global and, of course, Brexit will not impact all our members.

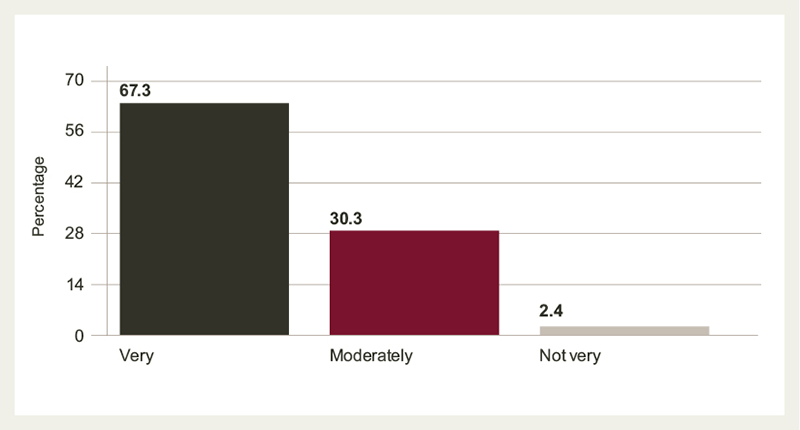

10) How competitive do you believe the syndicated loan market to be?

98% believe the market to be moderately or very competitive, of which 67% believe it to be very competitive, a response which is also reflected in answer one to this survey. This is a response that regulators and legislators should note as they review the loan market.

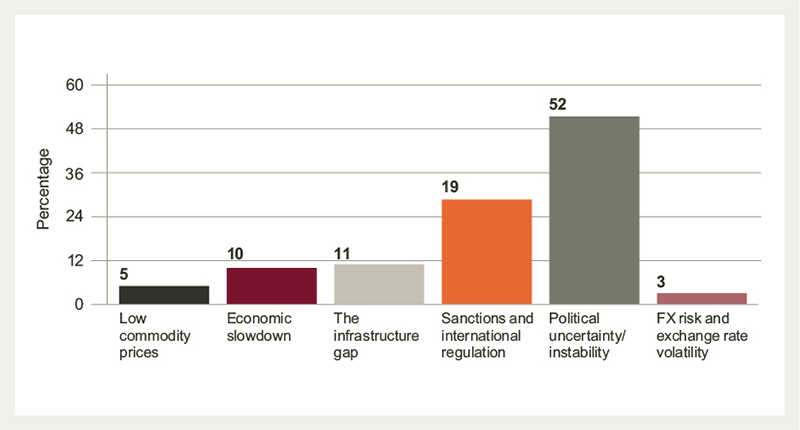

11) What do you think is the principle barrier to improving growth in developing market lending at the present time?

Geopolitical risk has been a hot topic for 2017, and not just in developing markets. With this in mind, it is unsurprising that political uncertainty/instability is the top result when considering principle barriers to developing market growth.

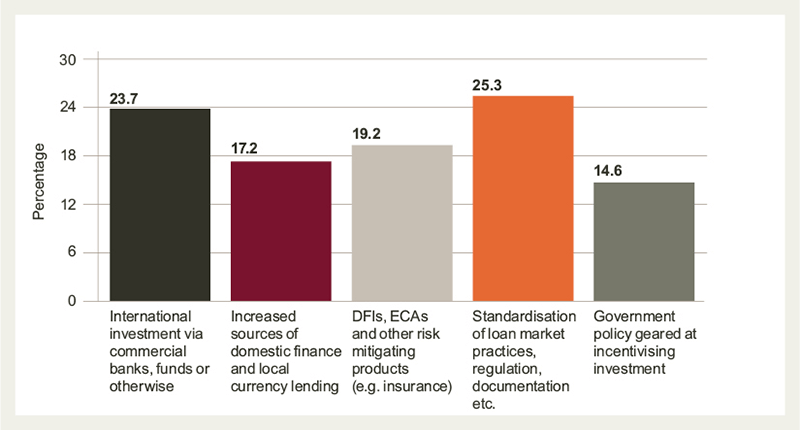

12) What do you think is the most important factor supporting developing market lending at the present time?

The results of the survey demonstrate that there is no obvious single solution when it comes to supporting developing market lending. However, the work of the LMA is clearly a fundamental part of the overall process, with the highest proportion of respondents (over 25%) believing that standardisation of loan documentation is the most important factor.

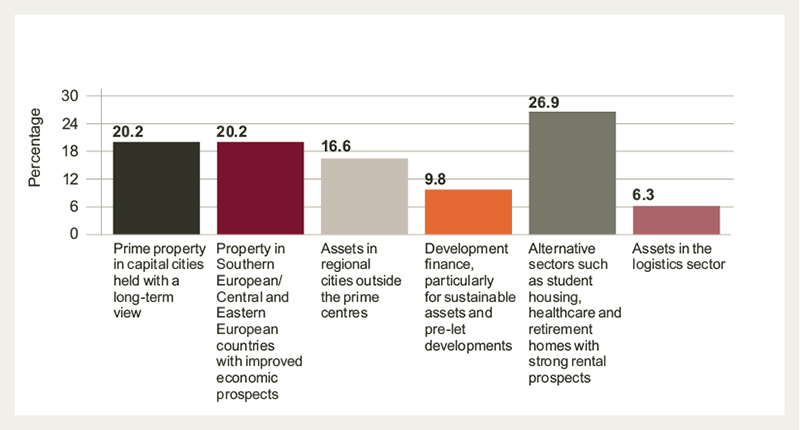

13) In which types of commercial real estate assets do you see the greatest potential for growth?

Competition in the real estate finance sector remains fierce. When combined with the hunt for yield, it is understandable that alternative sectors are seen as having the greatest potential for growth in 2018.

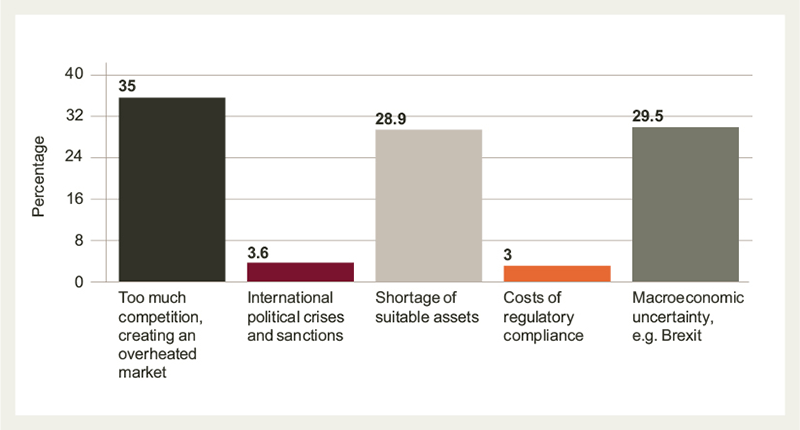

14) What do you think will be the greatest challenge for the European real estate market in 2018?

In a market already supporting a very healthy amount of competition, it is not surprising that this option is rated the greatest challenge going forward, particularly given the impact macroeconomic uncertainties are having on companies' willingness to borrow. A shortage of assets amid surplus demand gives rise to valid concerns that overheating may take place.