Press Releases

LMA releases results of its Nordic Loan Market Survey

23 May 2016As part of the run up to the LMA's Stockholm Seminar on 23 May 2016, the LMA surveyed its membership on the opportunities and challenges facing the Nordic loan market. The results, set out below, were collected anonymously and represent the personal views of professionals actively working in the Nordic syndicated loan market. To view a comparison of our 2016 results with 2015, click here.

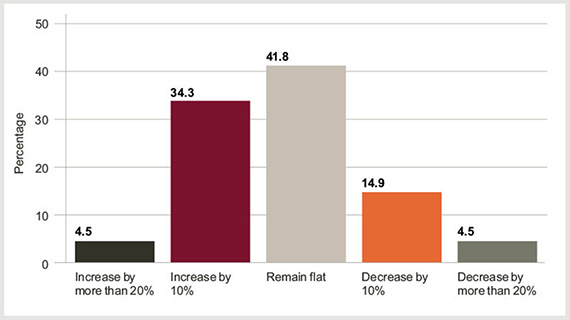

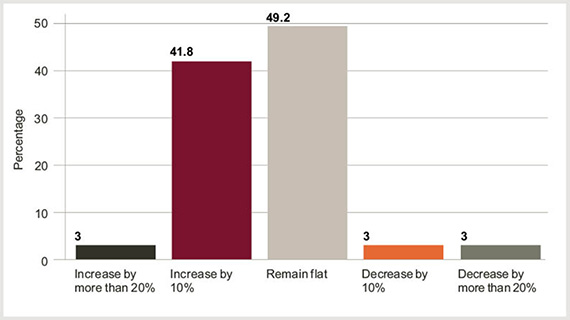

Question 1: What is the outlook for loan refinancing volume in the Nordic loan market in the next 12 months?

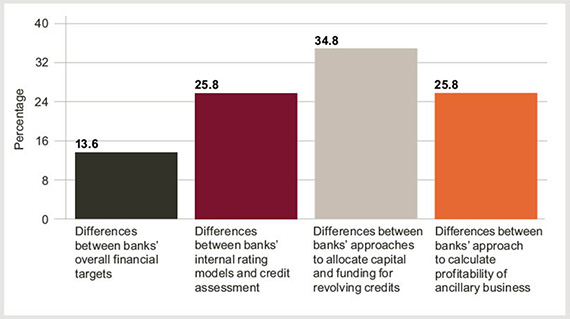

Question 2: What is the main driver behind the current competitive dynamics in corporate refinancing?

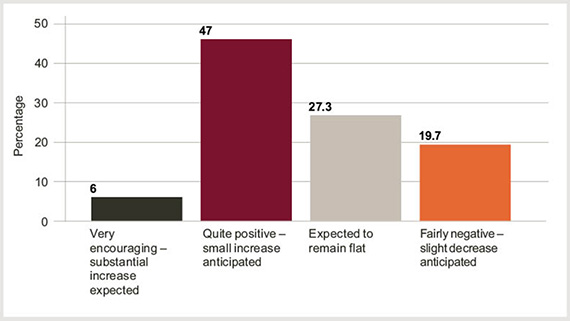

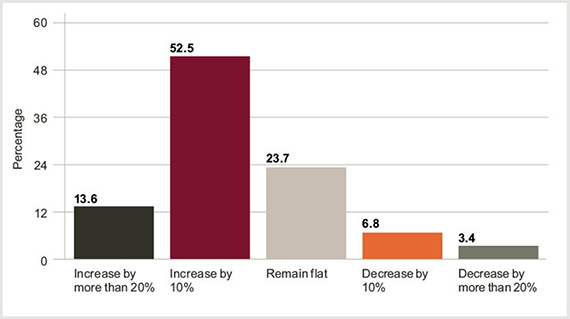

Question 3: What is the outlook for corporate M&A loan financing volume in the Nordic market in the next 12 months?

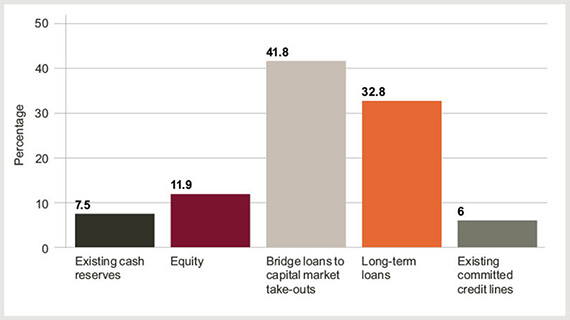

Question 4: What is the main financing tool in Nordic corporate M&A transactions within the next 12 months?

Question 5: What is the volume outlook in Nordic sponsor-driven leverage loan markets in the next 12 months?

Question 6: Which direction will institutional non-bank investors' involvement in Nordic loan capital markets develop within the next 12 months?

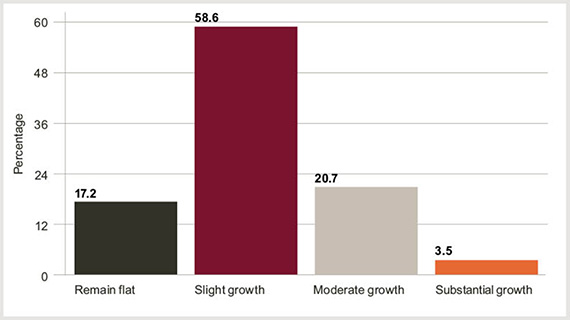

Question 7: What are your predictions for growth of the Nordic private placement market over the next 5 years?

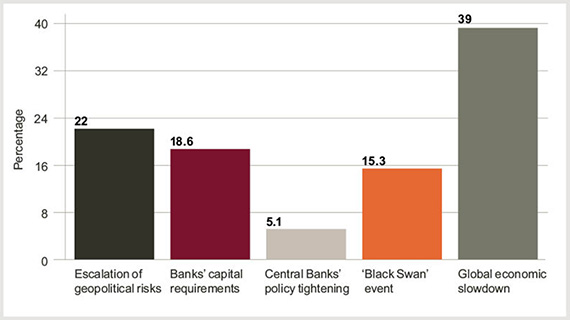

Question 8: What poses the main risk in regards to loan market sentiment for the remainder of the year?