Press Releases

LMA releases results of its Real Estate Finance Survey

02 May 2016As part of the run up to the LMA's fourth real estate finance conference, the LMA surveyed its membership on the opportunities and challenges facing real estate finance markets. The survey aimed to determine where the key investment opportunities and challenges lay in Europe, which sectors and asset classes were most likely to drive future growth and where future lending would most likely be sourced from.

The results, set out below, were collected anonymously and represent the personal views of professionals, from 17 countries, actively working in the real estate finance market in Europe. Download pdf of the results.

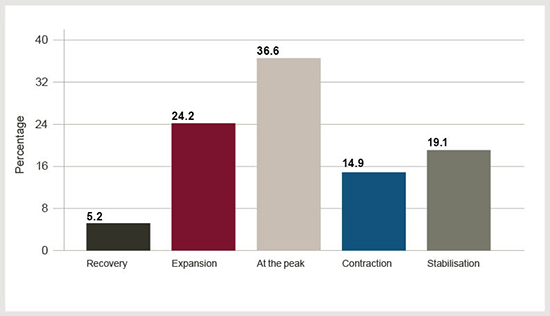

Question 1: Where are we currently in the property cycle?

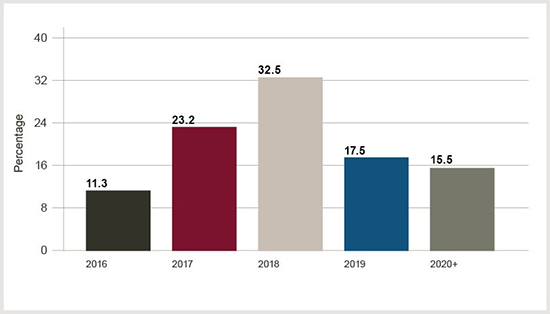

Question 2: In which year do you believe the next property turndown will commence?

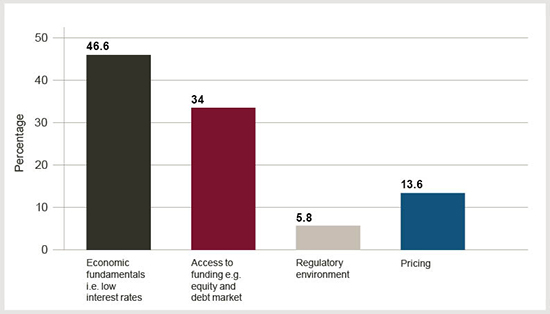

Question 3: What do you believe will be the biggest driver of growth in commercial real estate?

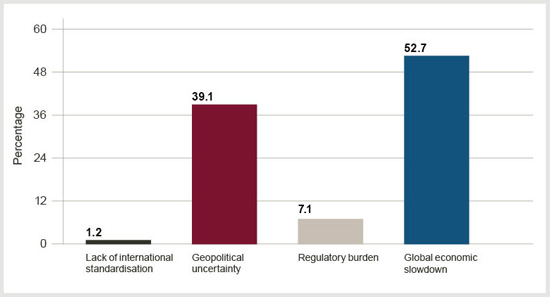

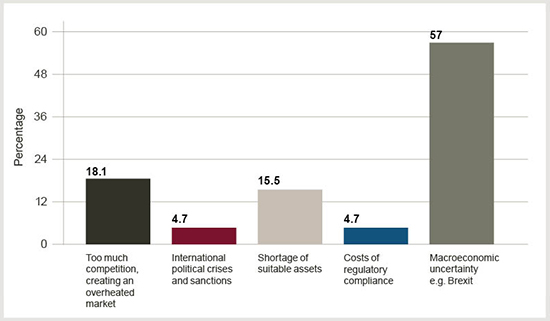

Question 4: What do you think will be the greatest challenge for the European real estate market in 2016?

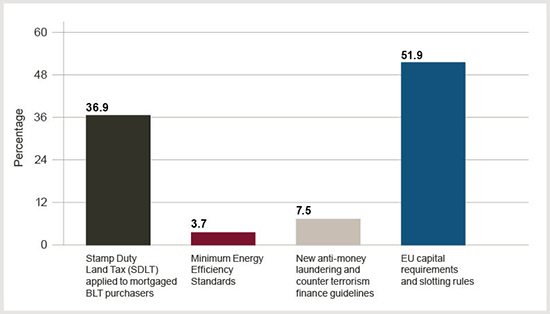

Question 5: Which regulatory issue do you believe will prove the biggest burden for UK commercial real estate on 2016?

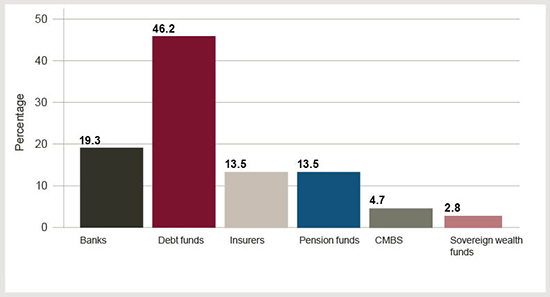

Question 6: Which lending “source” do you think will demonstrate the greatest growth in real estate lending in 2016?

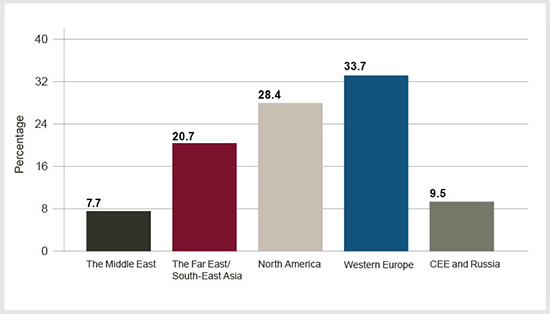

Question 7: Which region do you believe has the most favourable conditions to deliver the greatest investment in real estate in 2016?

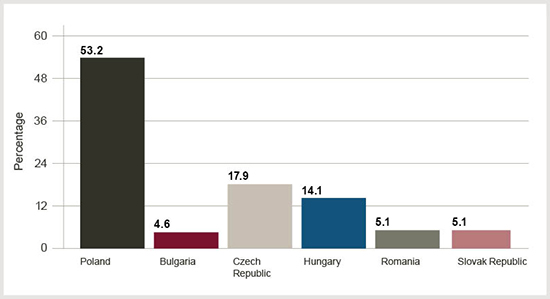

Question 8: Commercial real estate investment in Central and Eastern Europe (excluding Russia) reached over €7.37bn in 2015. Which CEE country do you believe holds the greatest investment opportunities going forward in 2016?

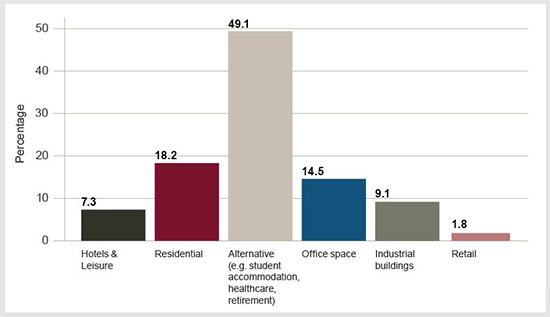

Question 9: Which sector do you believe holds the greatest investment opportunities in the UK in 2016?

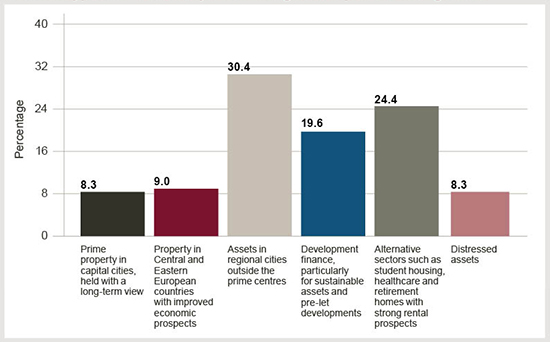

Question 10: In which types of assets do you see the greatest potential for growth?

Question 11: What do you think will be the greatest concern for borrowers in the global real estate market in 2016?