Press Releases

LMA surveys membership on outlook for the syndicated loan market in 2015

04 December 2014In November 2014, we surveyed our membership on the outlook for the syndicated loan market over the next 12 months. The survey comprised 12 multiple choice questions covering both the primary and secondary markets in general, real estate finance and the developing markets specifically, and lastly regulation.

The results below were collected anonymously and represent the personal views of our members, from 32 countries, actively working in the loan market today.

Click here to download a copy.

Question 1:

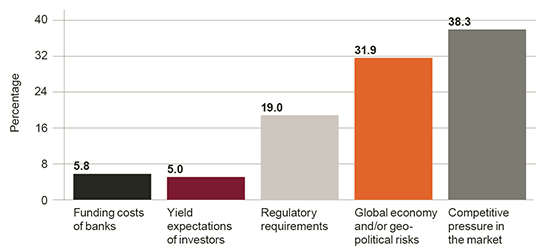

Which topic do you think will most influence the syndicated loan market over the next 12 months?

Not surprisingly competitive pressure in the market remains for the second year in first place at 38.3%. However, the doubling to 31.9%, from last year’s score, and into second place, of those who believe global geopolitical and/or economic risks are most likely to influence the loan market, reflects an awareness that external factors could impact the market in the year ahead. Regulatory requirements remains at around 20%.

Question 2:

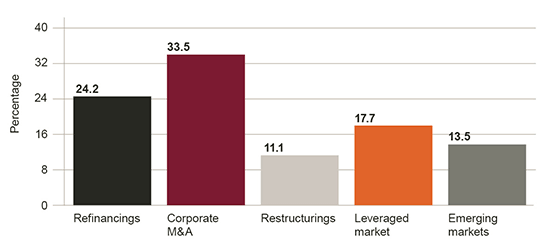

Next year, where do you think the best opportunities will lie in the loan market?

Despite increased concern around the economy and potential geopolitical issues, there is a clear increase in confidence that the year ahead will see more M&A opportunities. This area has now passed refinancing as the best opportunity with a 13.4% increase on last year to 33.5%. Leveraged finance remains constant at around 18%, but opportunities in emerging markets is down to 13.5%, probably reflecting the earlier noted economic concerns.

Question 3:

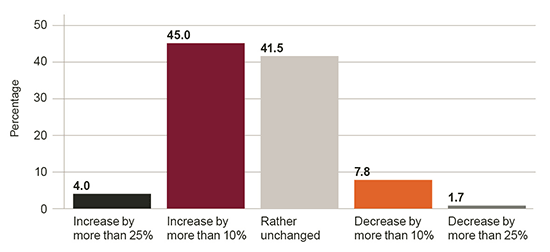

What are your volume expectations for 2015 in the EMEA primary syndicated loan market?

The increase in expected M&A, however, has not materially driven increased volume expectations. In fact, more believe volumes will remain unchanged this year than last year (41.5% against 34.6% in 2013), probably reflecting the already evidenced recovery in volumes this year.

Question 4:

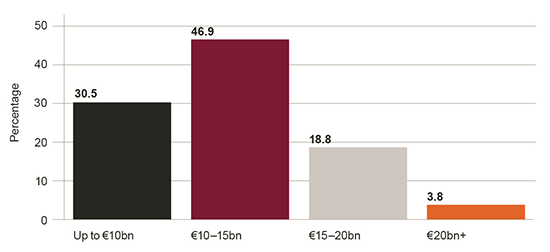

What will the volume of CLO issuance in Europe be in 2015?

With over 30 vehicles priced to the end of November and a strong pipeline, full year 2014 CLO issuance volume should top €14 bn, at the upper end of market forecasts and nearly double that seen in 2013 (source: S&P Capital IQ LCD). Having shown cautious optimism in last year’s survey, respondents remain generally conservative with the majority seeing 2015 issue volumes in line with or lower than this year.

Question 5:

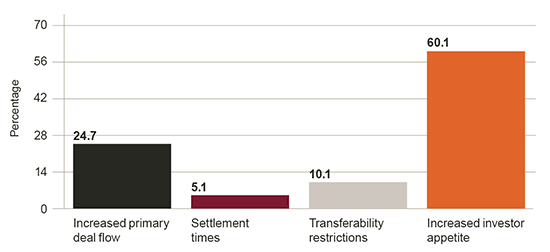

What has been the greatest influence on secondary market liquidity in 2014?

Buyside appetite has undoubtedly supported secondary loan pricing through a more volatile second half of the year, and the strong investor appetite tops respondents’ returns for directional influence also on liquidity this year. Primary deal flow will always be a factor but results here point to there being more (or bigger) mouths to feed.

Question 6:

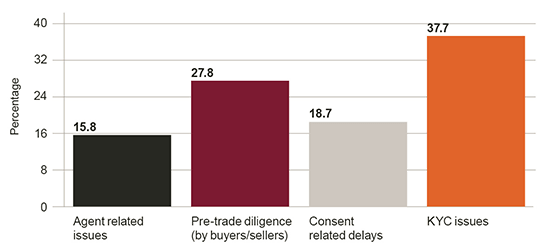

What affects settlement times the most in the current market?

KYC requirements and related delays have had a negative impact on secondary settlement for some time and are now singled out by respondents as the key problem. Agent related issues, which would necessarily include processing delays such as transfer freezes, are perhaps less of an issue, as may have been suggested during the secondary session at the LMA Syndicated Loans Conference in September.

Question 7:

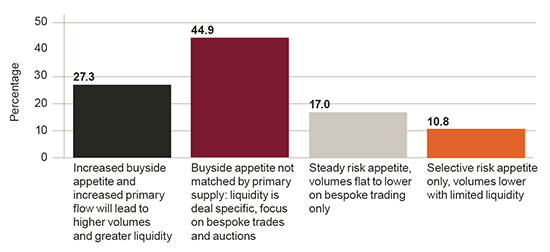

What are your expectations for the secondary market in 2015?

In line with survey results last year, most respondents see the secondary demand versus supply imbalance continuing into 2015, with trading more deal specific than broad-based. Auction volume in 2014 has been on a par with last year (according to LCD) and is predicted to be a factor again next year.

Question 8:

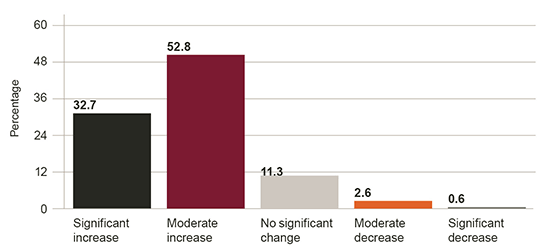

In five years’ time what will be the change in market share in volume terms of non-bank finance in the loan market?

85.5% believe that there will be at least a moderate or significant increase in non-bank finance over the next five years. This reflects the regulatory drive to encourage the provision of credit away from the banking market and source funds from other providers.

Question 9:

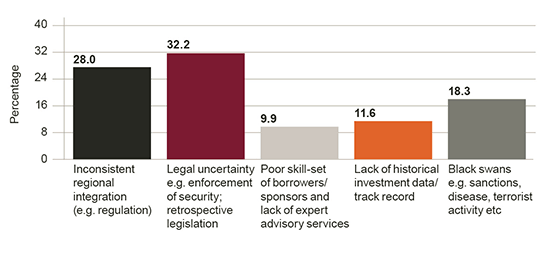

What do you think is the principle barrier to developing market lending at the present time?

There are two clear barriers preventing the development of lending into emerging economies, according to respondents: legal uncertainty and inconsistent regional integration. Whilst these are obstacles that require a substantial amount of time and effort to overcome, they are at least issues which national governments can seek to tackle and overcome, suggesting that investment will increase considerably if they were to be addressed.

Question 10:

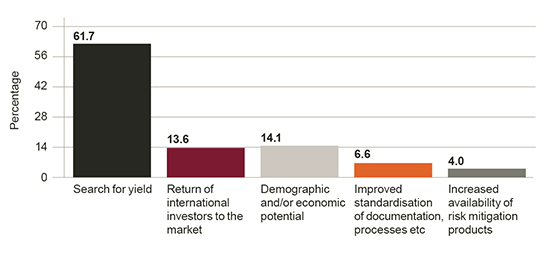

What do you think is the primary factor driving developing market investment at the present time?

It is perhaps unsurprising that the search for yield continues to drive investment into developing markets, with over two thirds of respondents citing this as the primary factor governing their decision to lend into emerging economies.

Question 11:

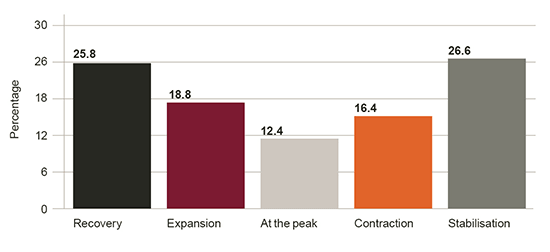

Where do you think Europe currently is in the property cycle?

In a commercial real estate market which is becoming increasingly competitive, it is positive to see that 26.6% of respondents believe the European property cycle is entering a period of stabilisation. However, there is obviously still work to be done in promoting liquidity, with 25.8% of respondents believing the European property cycle is in a period of recovery.

Question 12:

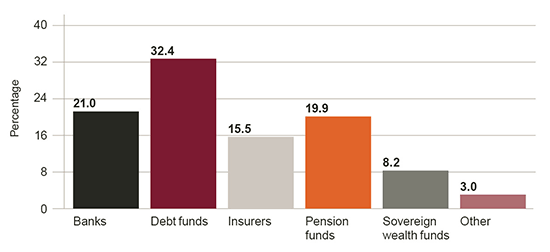

Which lending ‘source’ do you think will demonstrate the greatest growth in real estate lending in 2015?

There has been a clear shift in the composition of investors active in the real estate finance market in recent years. It may therefore not be surprising that 79% of respondents believe that it will be the non-banks who will demonstrate the greatest growth in real estate lending in 2015.